The objective of Retirement Income Planning AF8 is to develop and demonstrate the advanced skills needed for advising on income planning to those in and approaching retirement. John is the Head of the Tax Retirement Estate Planning Services Wealth team at Manulife.

My Bloginfographic 101216 Retirement Retirement Planning Year Start

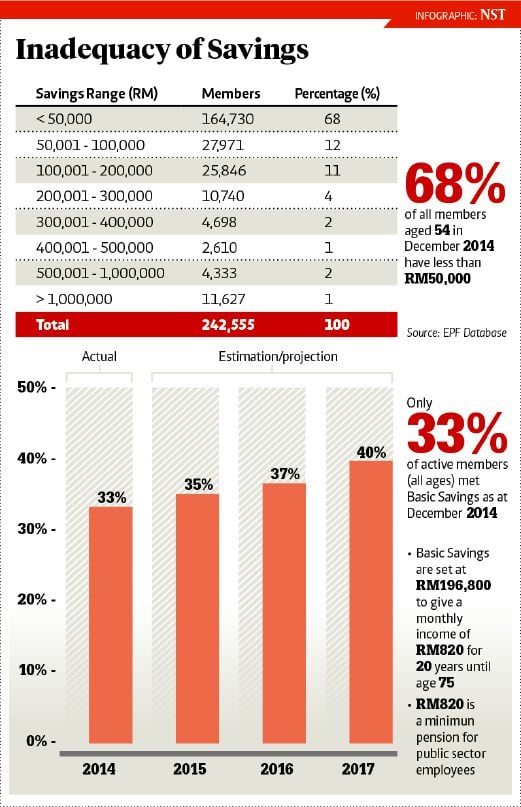

Educating Malaysians On Retirement Savings

How Much Do Malaysians Really Need For Retirement

47800 Petaling Jaya Selangor Darul Ehsan Malaysia.

Retirement planning malaysia. This unit is relevant for paraplanners technical consultants and those in financial planning support roles. Click here for an important notice for international deliveries. Investment Rate Of Return During Retirement.

Current Annual Net Income. Latest version of the core learning content in digital format only. Retirement Planning can be described as the process to plan the long-term and short-term financial goals and the ways to accomplish these goals.

Years To Retirement Retirement Age - Current Age. Retirement Planning involves identifying different income sources analyzing the financial objectives estimating the future expenses opting for savings program and managing risk and assets. Below are questions that can be answered based on your assumptions using the values you provide.

Start planning for. Gotto and his colleagues have found tax planning is very overlooked when it comes to the preparation side of retirement. Retirement should be a time of relaxation.

John joined Manulife in 2001 having previously worked as a tax lawyer with a national accounting firm and a private law firm. The default Enrolment option for this unit includes. This also provides an approximate amount that you may need to save every month for securing yourself financially.

Current Annual Expenses. Retirement is the phase of life that can bring some of us a huge financial and lifestyle change. Module 3 Investment Planning and Retirement Planning Download Syllabus Module 4 Financial Plan Construction and Professional Responsibilities Download Syllabus The shortest time frame to complete the program is 9 months.

Pensions and Retirement Planning R04 is a core unit for the Diploma in Regulated Financial Planning which meets the FCAs qualification requirements for retail investment advisers. Abdul Naser Abdul Ghani is happy to announce the continuation of its academic partner membership to CABE or the Chartered Association of Building Engineers. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan under.

Retirement planning involves many variables. The new MSN Your customizable collection of the best in news sports entertainment money weather travel health and lifestyle combined with Outlook Facebook. And make monthly withdrawal of an amount that you will need.

The Retirement Calculator should be used as a guide and not as a guarantee of meeting your retirement savings goal or intended to provide investment advice. The Thrift Savings Plan TSP is a defined contribution retirement savings and investment plan for federal civilian employees and members of the uniformed services. MALAYSIA RETIREMENT PLANNING ESTIMATES YOUR EPF FUND Many people rely on their EPF Saving.

Only licensed representatives of ADP BD or in the case of certain products of a broker-dealer firm that has executed a marketing agreement with ADP Inc. Malaysians need to change their mindset and attitude when it comes to retirement planning. USM ARCHITECTURE COURSE EARNED INTERNATIONAL ACCREDITATION FROM CABE USM PENANG 6 November 2020 - The Universiti Sains Malaysia USM School of Housing Building and Planning HBP Dean Assoc.

Based on new 45 dividend 22nd March 2009 Your details Current Age. Retirement planning should include determining time horizons estimating expenses calculating required after-tax returns assessing risk tolerance and doing estate planning. The decision to put off planning for the future.

Prepare for everything from living expenses to healthcare to planning. But the reality is sometimes not as rosy as we expect it to be. May offer and sell ADP retirement products or speak to retirement plan features andor investment options available in any ADP retirement product and only associated persons of ADP Strategic Plan Services LLC SPS may speak to any.

Request a Callback Calculators. More often than not we end up underprepared when facing the unforeseeable future. Retirement income lasts until age if For retirement income withdraw only interest is not checked then your retirement plan will assume you do not expect any income from your investments beyond this age.

Manulife Malaysia offers an innovative range of financial protection health and wealth management products and services to meet different customer needs. The number of health savings accounts HSAs is soaring but most account holders fail to take full advantage of the retirement planning power of HSAs. He and his team provide case-level support on tax retirement and estate planning matters to advisors across the country.

A retirement planning calculator calculates the corpus you may require to accumulate by the time you get retired. Sovereign is a market leader in the provision of International Pensions with a broad proposition that includes. Upon retirement you will keep your savings invested with 4 default rate of return pa.

Estimated Life Expectancy. QROPS QNUPS IPPs Corporate Pension Plans. As with other financial calculators on this site this retirement planning calculator can solve for multiple unknowns.

Retirement Planning Learn how much you need to retire comfortably and how to prepare for the unexpected in retirement. Estimated Annual Salary Growth Rate. Annual contribution increase assumes your annual contribution will go up over the years.

Can I retire at age 55. A TSP account can be divided by means of a court order in an action for divorce annulment or legal separation. We have been conditioned to think of retiring at the age of 55 for too long.

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. To accumulate a corpus of Rs69859838 at the time of retirement so as to maintain the same standard of living post retirement. A basic online pension calculator in India has the following fields.

Investment Rate Of Return Until Retirement.

Building A Retirement Nest Imoney

18 Quick Tips To Improve Retirement Planning In Malaysia

Learn How To Save For Retirement In These Pandemic Times The Star

Tug Of War Between Retirement Planning And Education In Malaysia

Ep2 Retirement Planning Savings With Prs Introduction Of Prs Industry Youtube

Malaysians Lack Of Retirement Planning Awareness Worrying Financial Planner Says Malaysia Malay Mail

Retirement Planning Starts Now 13 March 2011 Whitman

Top 5 Retirement Homes In Malaysia For 2021